New Frontiers in Climate Finance

Investment decisions made in low- and middle-income countries leading up to 2030 will determine whether low-carbon pathways out of poverty and climate vulnerability are possible for millions, and whether the next global surge in emissions can be prevented.

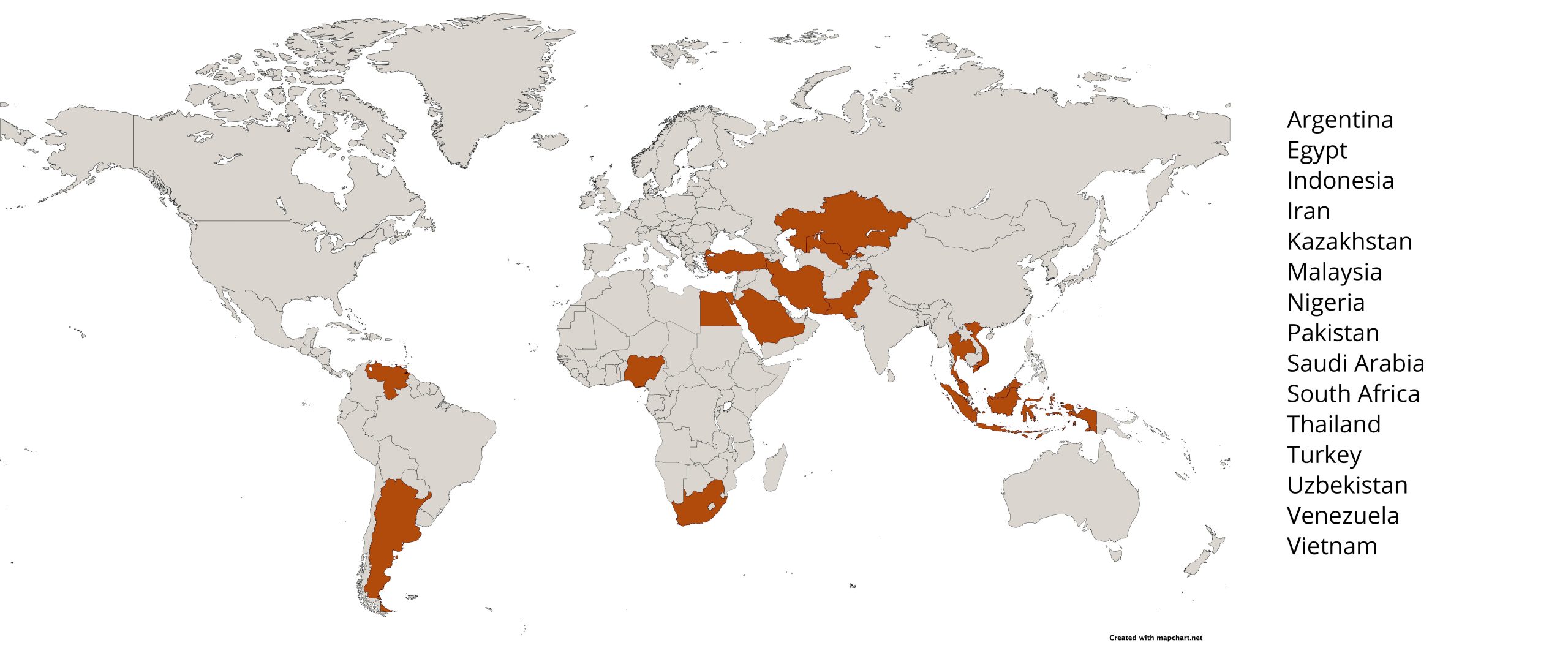

There is an increasing realization that (1) the way in which low- and middle-income countries (LMICs) develop over the next decade has outsized influence over how and whether global climate targets can be achieved and (2) investment is not flowing to these countries at the type or level needed to demonstrate and scale low-carbon development strategies. The growth and continued reliance on fossil fuel-intensive development in just 15 emerging economies (Figure 1) — home to nearly one fifth of the global population — may drive an emissions wave over the next two decades akin to what China produced during the last two.

Figure 1. The “Emerging 15.” The top 15 greenhouse gas emitters outside of Brazil, Russia, India, and China and Organisation for Economic Co-operation and Development countries.

There are another 15 developing countries — home to nearly 1 billion people — where fossil fuel use remains much lower, but where powerful transformative forces are also at work. These “Next 15” have some of the highest rates of population and economic growth and urbanization, and their people are expected to be some of the most climate vulnerable on the planet. Demonstration that new low-carbon development pathways are feasible is critical to support these countries’ aspirations.

Figure 2. The “Next 15.”

Note: Beyond the Emerging 15, these countries represent places where high economic growth, high population growth, high climate vulnerability, and low levels of development make low-carbon development pathways critical national priorities.

The New Frontiers in Climate Finance project is scoping the challenges and opportunities inherent to climate finance in LMICs, and seeking to help increase the scale and transformational impact of climate finance to these economies. The project aims to mobilize key stakeholder organizations around a common vision for aligning the tools of development finance with the needs and strategies of LMICs, and to build low-carbon development pathways that support poverty alleviation while reducing the next global wave of greenhouse gas emissions.

Duke Faculty/Staff: Jonathan Phillips, Jackson Ewing, Victoria Plutshack, Liilnna Teji, Marc Jeuland

Duke Students: Abhay Venkatesh Rao, Abi Vanover, Jide Olutoke, and Rajat Khandelwal

Climate Finance Myth Busting

Climate finance to low- and middle-income countries (LMICs) to help mitigate and adapt to climate change will be at the center of debate in Egypt at the 27th annual UN climate conference. Issues on the table range from investment targets for developed countries, loss and damage, programs and reforms of key institutions, and more. What follows are five important and commonly misunderstood concepts that I frequently encounter in this space, along with my best attempt at unpacking them.

Duke Faculty/Staff: Jonathan Phillips

EAP@Duke blog, November 2022

Just Energy Transition Partnerships and other ways to shift climate finance toward low-income countries

Important progress is underway on climate finance to developing countries, although you may have missed it in COP27 read-outs. The legacy of the Egypt gathering will be the creation of a Loss and Damage (L&D) Fund that, theoretically, will help poor countries recover from increasingly frequent and devastating climate-related events. Today, however, the L&D Fund is merely a freshly opened, depressingly empty bank account. No decisions were made in Egypt regarding how much money will go in the bank account, who will deposit it, when it will be deposited, who can withdraw it, or for what purpose. Meanwhile, mostly outside the COP27 negotiating text, developments across three other critical fronts hold potential for shifting the underlying dynamics holding back low-carbon investment in low- and middle-income countries (LMICs): carbon markets, Just Energy Transition Partnerships, and reform of the development finance institutional architecture. These are the areas where engagement from governments, private sector actors, civil society and researchers hold the most promise for moving the needle on investment in 2023 and beyond.

Duke Faculty/Staff: Jonathan Phillips and Jackson Ewing

ImpactAlpha, December 2022

U.S.-China friction and the competition for global climate leadership

Previous instances of U.S.-China climate cooperation had consequential impacts. After years of mutual scapegoating that hamstrung global climate negotiations, the two countries surprisingly reached three bilateral agreements from 2014-2016. These substantive, quid pro quo, pacts were instrumental for crafting and ratifying the Paris Agreement; providing the rudder for international climate diplomacy in the years since. More recently the two sides agreed to extend climate cooperation at the 2021 climate summit in Glasgow. But they needed to rekindle this cooperation at the 2022 summit in Sharm El-Sheik after it was scuttled in the wake of U.S. House Speaker Pelosi’s Taiwan visit. Core practitioners remain involved on both sides, most importantly climate envoys John Kerry and Xie Zhenhua, who lead cooperative efforts stretching back more than a decade.

Duke Faculty/Staff: Jackson Ewing

The Azure Forum, February 2023

The State of Blended Finance 2023: Climate Edition

This year’s edition of the State of Blended Finance once again focuses on climate. Climate change continues to be central to the blended finance market and to sustainable development more broadly.

Blended finance uses catalytic capital from public or philanthropic sources to increase private sector investment in developing countries to realize the Sustainable Development Goals and climate goals. Blended finance allows organizations with different objectives to invest alongside each other while achieving their own objectives (whether financial return, social/environmental impact, or a blend of both).

The report from Convergence drew on thought leadership and contributions from several organizations, including Duke University’s Nicholas Institute for Energy, Environment & Sustainability. Jackson Ewing, director of energy and climate policy at the Nicholas Institute, and Jonathan Phillips, director of the James E. Rogers Energy Access Project at Duke, offered insights in parts V, VI, and VII of the report.

Part V explores country-level platforms in climate blended finance and evaluates Just Energy Transition Partnerships (JETPs) as a partnership model for mobilizing climate blended finance. JETPs are analyzed and compared through stakeholder interviews that identify strengths, challenges, opportunities, and recommendations.

Parts VI and VII highlight key areas where blended finance can contribute and offer specific recommendations on the role climate blended finance can play in driving private investments at scale while identifying the appropriate blended finance architectures in developing regions.

Ewing and Phillips were also among the experts and stakeholders interviewed for a deep dive on JETPs in the appendix.

Convergence Blended Finance, October 2023